work opportunity tax credit questionnaire on job application

Form 5884 with instructions 2. A date in the future.

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

The employee groups are those that have had significant barriers to employment.

. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. Please complete the attached form by following the instructions provided. Please pay special attention to page 5 Item C and page 7 Employer Appeals.

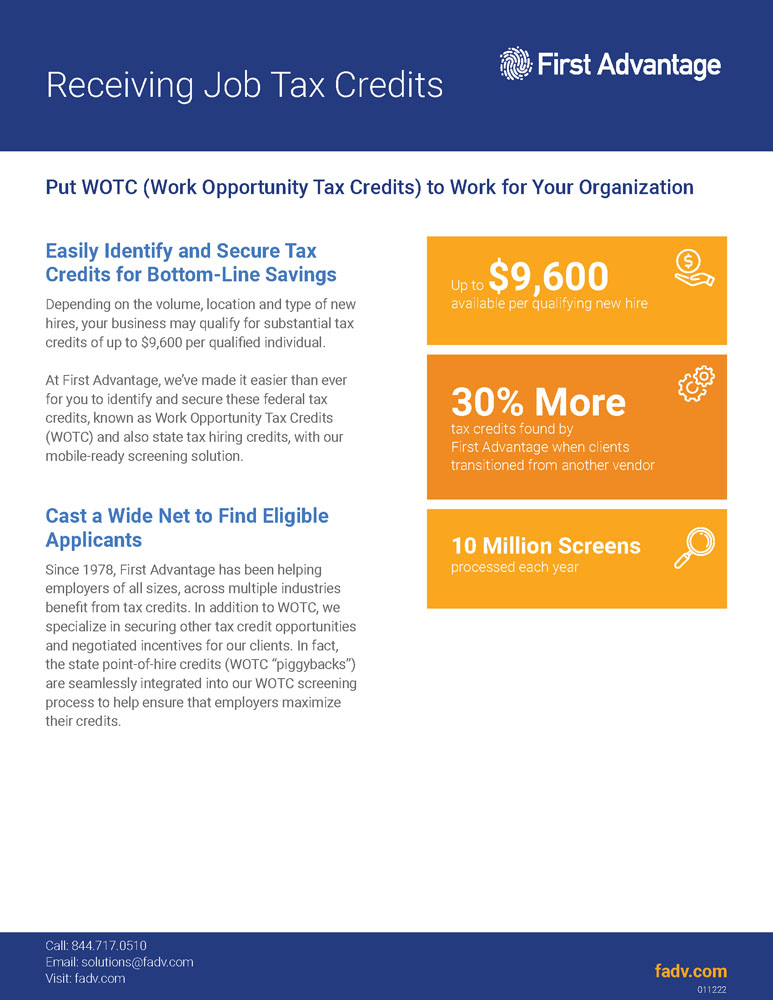

The Work Opportunity Tax Credit is a voluntary program. Completing Your WOTC Questionnaire. Through the Work Opportunity Tax Credit WOTC Program employers have the opportunity to earn a federal tax credit between 1200 and 9600 per employee.

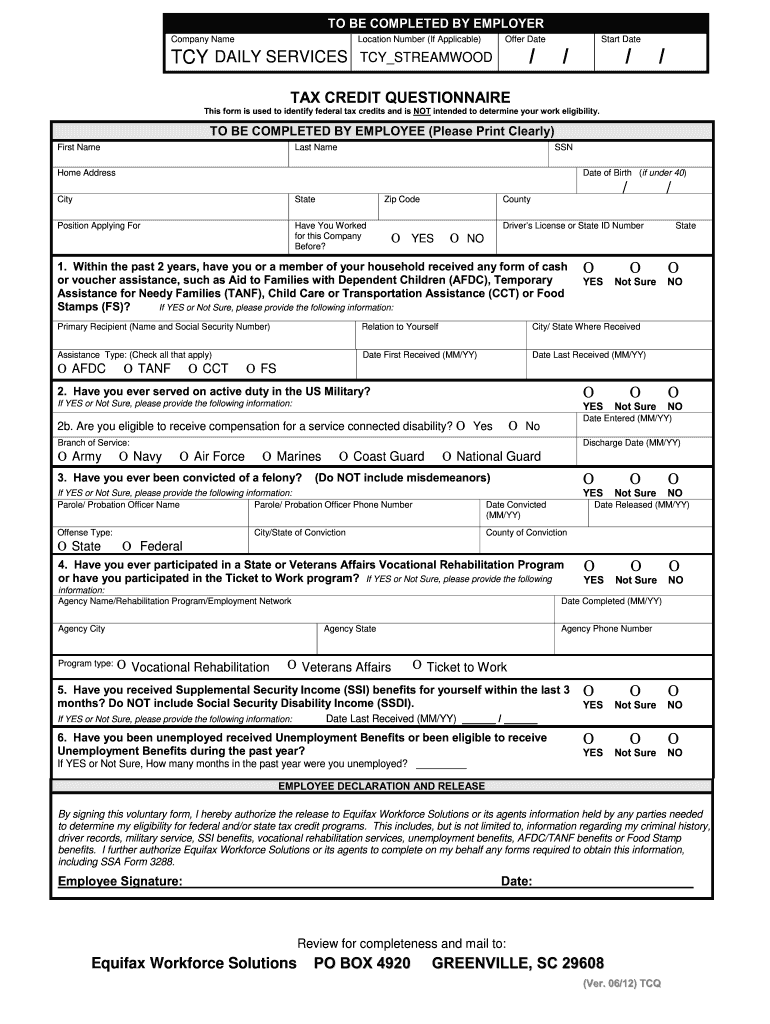

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. This tax credit is dependent upon the new employee qualifying as a member of one of the below target groups and working a minimum of 120 hours in their first year. It asks for your SSN and if you are under 40.

This tax credit is for a period of six months but it can be for up to 40 percent if the employer conducts job training. 9600 depending on the targeted group and qualified wages paid to the new employee generally during the first year of. Individuals hired as Summer Youth employees must work at least 90 days between May 1 and September 15 before an employer is eligible to claim the tax credit.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. EWOTC increases efficiency in processing new applications and decreases the. Thats why youll see job fairs targeting veterans or unemployed in IOWA or bumfuck nowhere Nebraska.

ABC COMPANY participates in the federal governments Work Opportunity Tax Credit Welfare to Work and other federal and state tax credit programs. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. The Work Opportunity Tax Credit WOTCan incentive for employers to broaden their job applicant pools and hire from certain groups of people who may need assistance finding jobs.

The credit is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more. PdfFiller allows users to edit sign fill and share their all type of documents online. Businesses can earn up to 9600 in business.

Below you will find the steps to complete the WOTC both ways. Ad Download Or Email Taxpayer Qnr More Fillable Forms Register and Subscribe Now. Apply for Work Opportunity Tax Credits You can use the online service eWOTC to submit WOTC Request for Certification applications and to view and manage submitted applications.

This tax credit program has been extended until December 31 2025. If you have any questions please contact the Tax Credit Services Unit at 800 345-2555 or RA-BWPO-TaxCreditspagov. The Workforce Opportunity Tax Credit WOTC program can reduce your cost of doing business while helping job seekers find and retain good jobs.

The data is only used if you are hired. BENEFITS TO EMPLOYERS. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

Available ranges from. The Date of Birth DOB field does not allow. The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals.

Work opportunity tax credit questionnaire on job application Monday March 7 2022 Edit. Below you will find the steps to complete the WOTC both ways. Your businesss related income tax return and instructions ie Forms 1040 or 1040-SR 1041 1.

WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person. Hit the arrow with the inscription Next to move on from one field to another.

To provide a federal tax credit of up to 9600 to employers who hire these individuals. It is legal and you can google it. Employers can still hire these individuals if they so choose but will not be able to claim the tax credit.

Completing Your WOTC Questionnaire. A date older than 130 years. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the WOTC eligibility questionnaire.

While they cant say ONLY certain demographics may apply they target tax-advantagous audiences. After the required certification is secured taxable employers claim the tax credit as a general business credit on Form 3800 against their income tax by filing the following. Enter the required information.

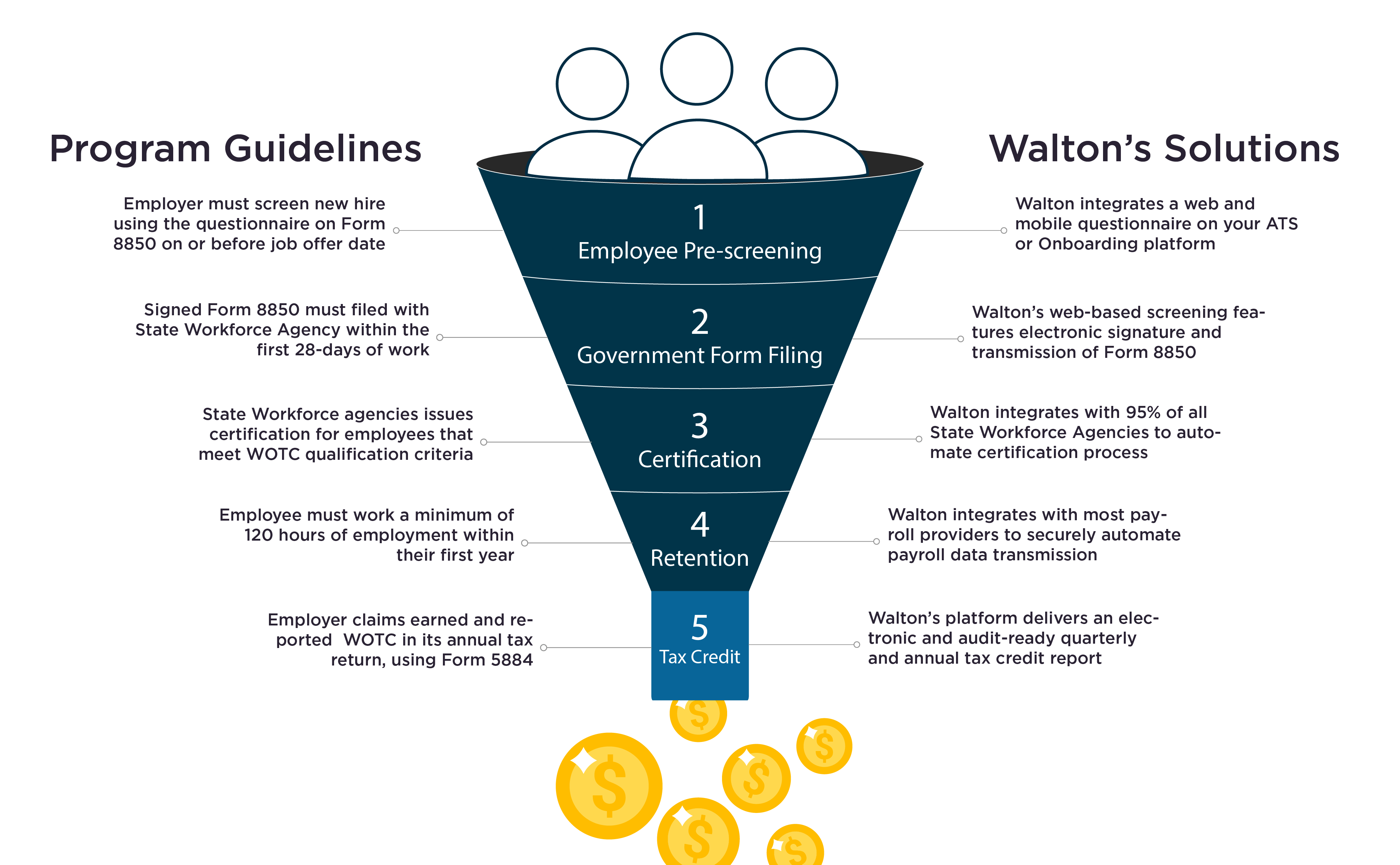

Employers must apply for and receive a certification verifying the new hire is a. WOTC is a Federal tax credit available to employers for hiring individuals from specific target groups who face barriers to employment. We need your help.

Select the Tax Credit Check task. What is the Work Opportunity Tax Credit. New hires may be asked to complete the WOTC questionnaire as part of their onboarding paperwork or even as part of the employment application in some cases.

This isthe Ernst Youngs vendor survey site. Secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes. The employer and the job seeker must complete the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credits IRS Form 8850 and sign under penalty of perjury attesting that the job seeker is a member of a target group.

The WOTC survey displays in the current browser window. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow.

Ad Download Or Email Taxpayer Qnr More Fillable Forms Register and Subscribe Now. Form 3800 with instructions 3. It also says that the employer is encouraged to hire individuals who are facing barriers to employment.

Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. The employer may request certification for the WOTC by submitting the Form 8850 and the ETA 9061 to the EDD either. Work Opportunity Tax Credit What Is Wotc Adp Work Opportunity Tax Credit Wotc Survey Form Fill Online Printable Fillable Blank Pdffiller.

Is participating in the WOTC program offered by the government. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Home credit job questionnaire tax. Please note employers must have their EIN registered with our Unemployment Commission to submit WOTC applications. How the Tax Credit Surveys are Used.

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credits Wotc Walton

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit First Advantage

Completing Your Wotc Questionnaire

How To Optimize Wotc Screening Emptech Blog

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

With Wotc Timing Is Everything Wotc Planet

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credits Wotc Walton

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller