does instacart take out taxes for employees

As an independent contractor you must pay taxes on your Instacart earnings. Does Instacart take out taxes for its employees.

What You Need To Know About Instacart Taxes Net Pay Advance

Does Instacart Take out Taxes.

. You should note that you dont have to pay self employment tax if your taxable profit is less than 400. As a result part-time shoppers make about 250 per hour. There is a 45 late fee plus interest for each month your tax return is late but only a 05 late fee for each month your payment is late.

Self-employment taxes cover the employee and employer portion so they can be expensive. The 1413 is the amount youll have to pay in self employment tax. For Instacart to send you a 1099 you need to earn at least 600 in a calendar year.

What that ultimately means is your actual self employment tax is 1413 of your Schedule C profits. Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats GrubHub driver etc. Download the Instacart app or start shopping online now with Instacart to get groceries alcohol home essentials and more delivered to you in as fast as 1 hour or select curbside pickup from your favorite local stores.

3015 reviews from Instacart Shoppers employees about Instacart Shoppers culture salaries benefits work-life balance management job security and more. I know it feels like a paycheck. If you made over 600 and you did not receive a 1099 contact Instacarts Shopper support right away.

Instacart delivery starts at 399 for same-day orders 35 or more. The organization distributes no official information on temporary worker pay however they do publicize that drivers can make up to 25 every hour during occupied occasions. If youre an employee stop reading.

This stuff applies just as much for Instacart Uber Eats Grubhub Postmates. Instacart does not take out taxes for independent contractors. Does Instacart take out taxes.

Accurate time-based compensation for Instacart drivers is difficult to anticipate. There will be a clear indication of the delivery fee when you are choosing your delivery window. Especially considering deductions I save 150 a month and should make around 15000 this year.

Get more tips on how to file your taxes. Fees vary for one-hour deliveries club store deliveries and deliveries under 35. When you make money as a traditional 9-5 employee the employer is in charge of taking taxes out of your paycheck.

Consider the different types of taxes you will need to pay as a shopper. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Instacart does not take out taxes for independent contractors. Save up about a third for taxes its high for independent contractors. Last updated June 26 2019 351 PM.

This includes self-employment taxes and income taxes. Minimum Batch Payment. Plan ahead to avoid a surprise tax bill when tax season comes.

This amount was previously 3 but after a PR snafu when changing up their payment structure once again the company increased the amount of the batch payments to between 7 and 10. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. If youre in an employee position Instacart will send you a W-2 by January 31st.

But when youre running a side hustle youre in charge of paying your own taxes. No taxes are taken out of your Doordash paycheck. Answer 1 of 4.

As Instacart shoppers you should know that being contracted as an employee means a. The 1099 thing is heating up Instacart Offers Employee Option To Its Contractors. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

How Strong Is A Verbal Agreement In Court. Instacart Q A. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022.

153 of that 9235 is 1413. Since you are not an employee ie. What You Need To Know About Instacart Taxes Net Pay Advance Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes.

As always Instacart Express members get free delivery on orders 35 or more per. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the service fee. A third is too much if instacart is your only income.

As always Instacart Express members get free delivery on orders 35 or more per. Instacart shoppers are paid a minimum amount for every batch or order they complete. Practically speaking however drivers will once in a while arrive at that 25 number.

As an independent contractor you must pay taxes on your Instacart earnings. Stride Tip If you ever owe more taxes than you can afford and youre not able to pay your entire owed tax on time make sure to file your tax return anyway. When you join Instacart they will ask you to provide either a W-9 or W-4.

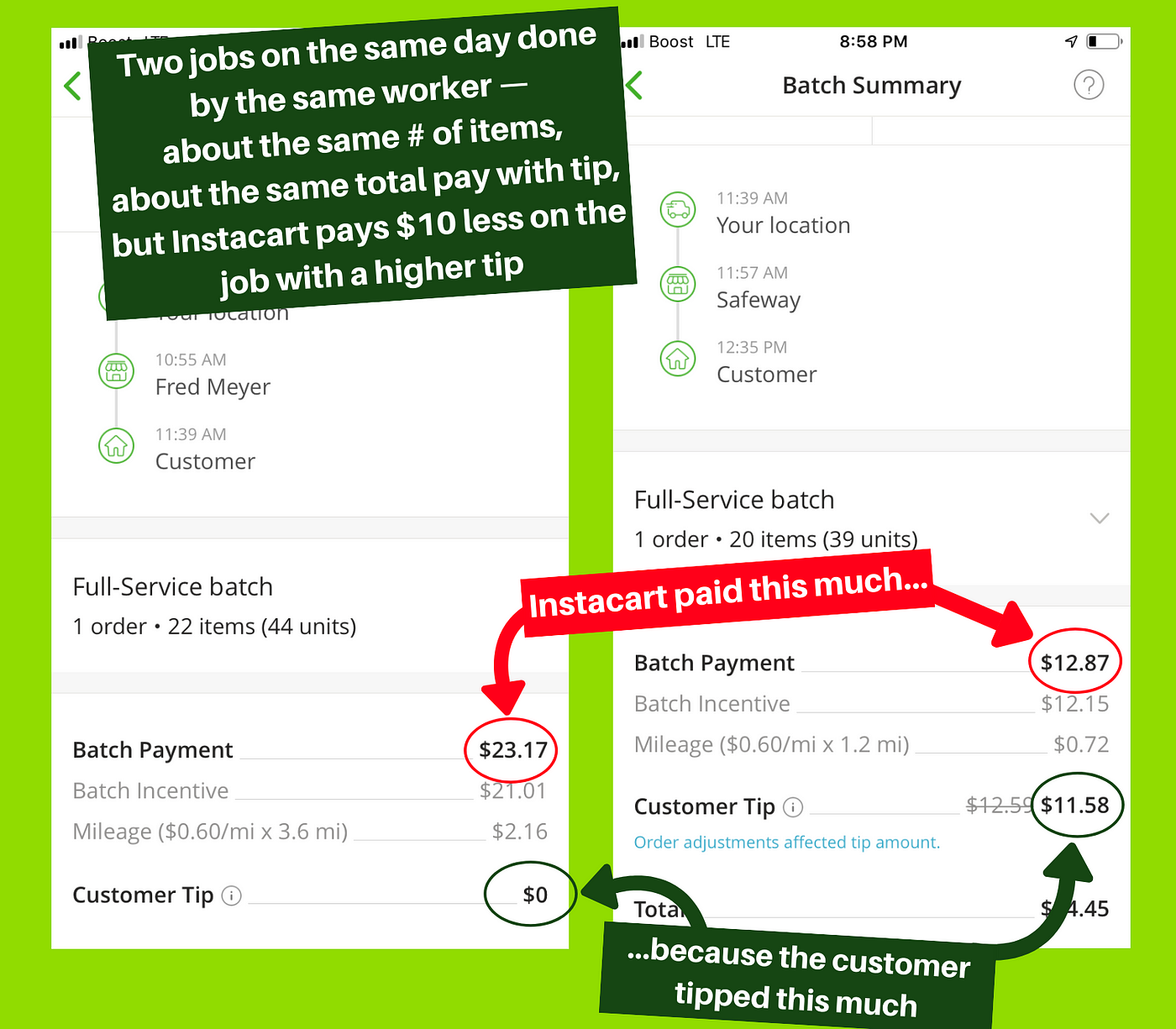

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms Coworker Org

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

I Want To Make A Payroll Tax Deposit De 88 Payment Youtube

How To Claim Expenses As An Employee

Instacart S Transparent New Pay Structure Underpayment Tip Theft And Black Box Algorithms Working Washington

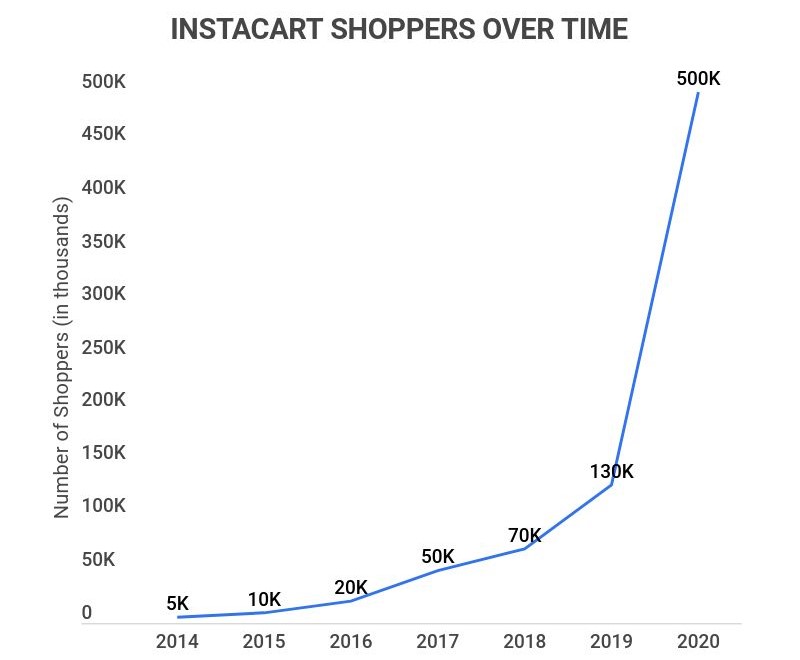

Instacart Statistics 2022 Users Revenue Growth And Grocery Ecommerce Market Trends Zippia

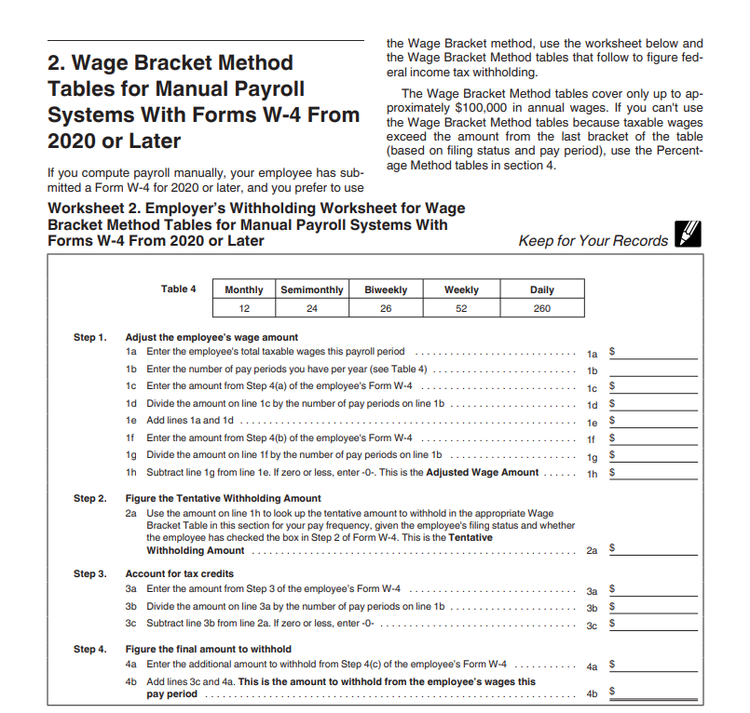

How To Calculate Payroll Taxes For Your Small Business

Payroll Tax Vs Income Tax What S The Difference

This Post Will Walk Through The Fourth Report In Bluegranite S Power Bi Showcase A Series Desig Employee Retention Data Visualization Machine Learning Models

How Much Does Instacart Pay Shoppers Per Hour Quora

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms By Working Washington Medium

How To Calculate Payroll Taxes For Your Small Business

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

When Does Instacart Pay Me A Contracted Employee S Guide

How To Calculate Payroll Taxes For Your Small Business

Intuit Quickbooks Desktop Pro With Payroll 2021 English Version Costco

Why Are Instacart Workers Calling On Costco For Support Payup